PMAY-credit linked subsidy scheme

The Pradhan Mantri Awas Yojana (PMAY) has been introduced by Prime Minister, Narendra Modi on 1 June 2015. PMAY Scheme is an initiative provided by the Government of India which aims at providing affordable housing to the urban poor. The mission is to provide housing for all by the year 2022, by that time Nation completes 75 years of its Independence.

If you are looking to own a home of your own, under the Pradhan Mantri Awas Yojana (Urban), PMAY (U) scheme, here are few important things to consider about the PMAY scheme, even while you arrange the amount for down payment, decide the location and the home loan lender.

The Credit Linked Subsidy Scheme (CLSS) for Middle Income Group (MIG) to be called CLSS for MIG I and MIG II, Nirmala Sitharaman announced the extension in the last date of Pradhan Mantri Awas Yojana (PMAY) Credit-Linked Subsidy Scheme (CLSS) for the individuals both in category MIG-I and MIG-II.

Before today, the last date for anyone who wants to enjoy the benefits of PMAY CLSS scheme was March 31, 2020. After the extension, you can avail the benefits till March 31, 2021.

The main objective behind this extension is to make sure that people coming from the lower strata of the middle class families can be benefited more. According to the estimation, more than 2.5 lakh families from the middle class background will be able to enjoy the benefits from this extension of the date. The annual income must be between INR 6 lakh to INR 18 lakh.

Who is Eligible for Credit Linked Subsidy Scheme?

To avail CLSS benefits, individuals must fall into any of these income categories:

- You or your immediate family (spouse and unmarried children) do not own a 'pucca' home anywhere in India. (you qualify, even if your parents own a home and you stay with them)

- Your income is up to INR 6,00,000 per annum [to avail CLSS: EWS (Economically Weaker Sections) or CLSS: LIG (Low Income Group)]

- Your income is from INR 6,00,000 to INR 12,00,000 per annum [to avail CLSS: MIG 1 (Middle Income Group 1)]

- Your income is from INR 12,00,000 to INR 18,00,000 per annum [to avail CLSS: MIG 2 (Middle Income Group 1)]

| Particulars | EWS | LIG | MIG I | MIG II |

| Household Income (Rs) | Upto 3 Lakhs | 3-6 Lakhs | 6-12 Lakhs | 12-18 Lakhs |

| Carpet Area in Sqcm | 30 | 60 | 160 | 200 |

| Interest subsidy (% pa) | 6.5% | 4.0% | 3.0% | |

| Maximum Loan Tenure | 20 years | |||

| Eligible Loan Amount (Rs) | 6,00,000/- | 9,00,000/- | 12,00,000/- | |

| Discounted NPV Rate | 9% | |||

| Upfront Amount of subsidy (Rs) for a 20 years Loan | 2,67,280/- | 2,35,068/- | 2,30,156/- | |

Other Eligibility Criteria for EWS/LIG and MIG Categories

- Property ownership must contain 1 female membership.

- A female member of the family must co-own the property.

- The household/applicant should not possess any pucca house in India.

- Property's location must be within the 2011 census statutory towns.

- Applicant should not have taken any government assistance under housing schemes previously.

What are the benefits of CLSS under PMAY?

- You can SAVE an amazing 4% in terms of interest for a loan of up to 9 lacs if your income is up to INR 12,00,000 per annum (you will fall under the CLSS MIG 1 Category)

- You can SAVE a cool 3% interest for a loan up to 12 lac if your income is from INR 12,00,000 to INR 18,00,000 per annum (you will fall under the CLSS MIG 2 Category)

- Income lower than INR 6,00,000? Then the Savings are even more substantial! A massive 6.50% interest concession awaits on loans up to 6 lac. (You will fall under the CLSS EWS/LIG Category)

Source: www.homeloandsa.com

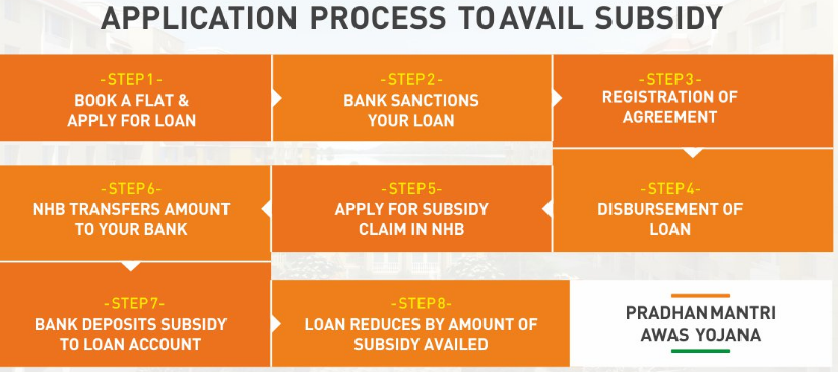

Begin by contacting the financial institutions covered under the PMAY scheme about your intention to avail a loan. They will then hand you the loan subsidy application, which you have to duly fill and submit along with the relevant documents. Upon verification, the housing loan amount will be disbursed to your bank account. Once this is done, your lender approaches the nodal agencies to start the process of injecting your bank account with the subsidy you are entitled to.

Key points on Credit Linked Subsidy Scheme

- The Credit Linked Subsidy Scheme (CLSS) is a benefit under the Pradhan Mantri Awas Yojana which focuses on helping the Middle Income Groups, Economically Weaker Sections, and Lower Income Groups in India by bringing down their housing loan EMIs by over Rs.2,000 per month by offering an interest subsidy.

- CLSS scheme is effective from 1 January 2017. Those who were sanctioned home loans and whose applications are under consideration since the beginning of the year will be eligible for interest subsidy.

- Over 70 lending institutions which include 45 Housing Finance Companies and 15 scheduled banks have come forward and signed the Memoranda of Understanding with the nodal agencies showing their support in implementing the PMAY Urban Scheme.

- To be eligible to avail a housing loan under CLSS, the beneficiary family should not own a pucca house in his/her or in the name of any member of his/her family in any part of India.

- Economically Weaker Sections and Low Income Groups who are seeking for housing loans from financial institutions and banks will be eligible for an interest subsidy of 6.5% for a period of 20 years or for the tenure of the loans, whichever is lower.

- This interest rate subsidy will be credited during the initial stage of the loan to the beneficiary's loan account through the lending institute which will lower their Equated Monthly Installments (EMIs).

- The funds borrowed under CLSS can be used to construct a new house or to add a room, kitchen, or balcony to their existing house.

- The beneficiaries under Economically Weaker Sections can have annual income up to Rs.3 lakh. Also, beneficiaries with an annual income of Rs.3 lakh to Rs.6 lakh fall under the Low Income Group category.

- The carpet area for Economically Weaker Sections can go up to 30 square metres and the carpet area for Lower Income Groups can go up to 60 square metres.

- Preference will be given to women, Scheduled Tribes, Scheduled Castes, backward classes, minorities, people with disabilities, and transgenders.

- Under the Middle Income Group, there are two sets of beneficiaries. The first set MIG-I covers people with an annual income of Rs.6 lakh to Rs.12 lakh p.a. The second set called MIG-II covers people who fall in the income group of Rs.12 lakh to Rs.18 lakh p.a.

- An Interest rate subsidy of 4% and 3% will be given to those who fall under MIG-I and MIG-II respectively. For both sets of beneficiaries, the maximum tenure of loan can go up to 20 years.

- The maximum loan amount can go up to Rs.9 lakh for MIG-I and Rs.12 lakh for MIG-II. Also, the discount rate for Net Present Value(NPV) is 9% for both MIG-I and MIG-II.

- Recently, the Cabinet increased the carpet area from 90 square metres to 120 square metres for MIG-I. The carpet area for MIG-II was also increased to 150 square metres which was 110 square metres previously.

Pradhan Mantri Awas Yojana has been brought to action to add fuel to your home purchase so as to ensure that you become the homeowner on easy, flexible terms. So, find a home of your choice to get benefit from the scheme until March, 2021.

For more details call + 91 7709058051